St. Germain Room Tax History:

The Accomodations Tax Commission was created by the Town Board aftrer adopting the Accomodations Tax Ordinance in 1998. By WI Statute, the Commission shall:

1. Periodically set the amout of the Accomodations Tax imposed by the Town

2. Report any delinquinces or inaccuracies in the reporting of Accomodations Tax to the Town Board

3. Use accomodations tax appropriated to the Commission to promote and develop tourism in the town

4. Submit a report to the Town Board on or before October 1 of each year itemizing its expenditures and proposing its budget for the next calendar year

5. Work in cooperation with the Town Treasurer to administer the Accomodations Tax

6. Cooperate with an annual audit of the expenditures of the Commission if such an audit is requested by the Town Treasurer

The Town Board adopted a revised "Accommodations Tax" ordinance on June 21, 2017. The primary purpose of the revision was to eliminate the Room Tax Commission created by the board in 1998. Room Tax Commissions are typically needed in municipalities where more than one organization is contracted with to provide tourism and marketing services utilizing room tax revenues. The Town of St. Germain has never contracted with anyone other than the St. Germain Chamber of Commerce for those services, therefore no real need exists for the Room Tax Commission. The Town Board now works directly with the Chamber rather than through the Commission. The "Accommodations Tax" ordinance, recently renamed "Room Tax" ordinance, can be viewed on the Ordinances page of this website.

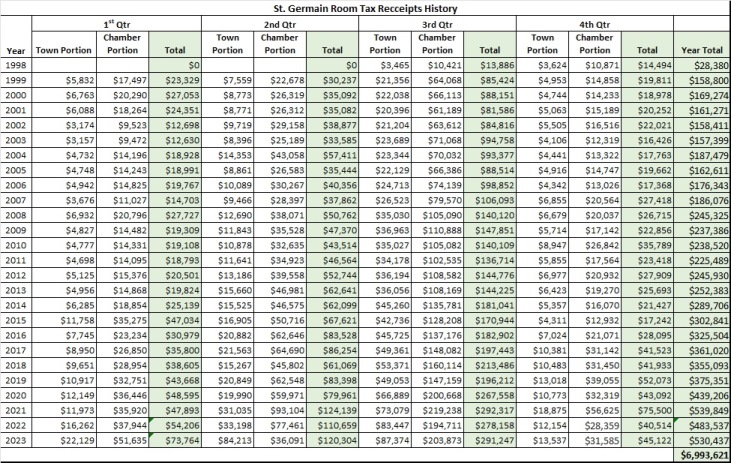

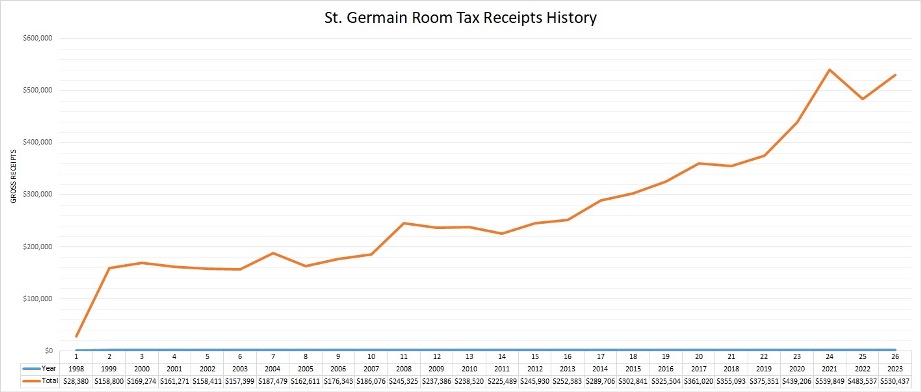

The below spreadsheet and chart represent St. Germain's annual gorss room tax revenues, of which 75% annual is provided to the Changer of Commerce for tourism development and promotion. The remaining 25% is under contro of the town board.

|

DISCLAIMER - The contents of the Town of Saint Germain website have been selected based on the belief they are accurate and reliable. However, the Town of Saint Germain is not responsible for, and expressly disclaims all liability for, damages of any kind arrising from use, reference to or reliance on any information contained within the site. While the information contained within the site is periodically updated, no guarantee is given that the information provided in this website is correct, complete and up to date. Links to any and all external sites are provided for user convenience. The Town of Saint Germain has no control over the format or content of any information found on non-Town of Saint Germain sites.